When AI Gets a Wallet: The Rise of Autonomous Agents in Crypto

A thesis on how intelligent agents, permissionless protocols, and Donut Browser signal the start of a new economic paradigm.

TL;DR

Agentic AI is not just a smarter tool — it’s autonomous software that acts on your behalf.

Real-world deployments (Klarna, GitLab, PepsiCo) show it’s already transforming industries.

Crypto provides the perfect execution layer: permissionless, composable, programmable.

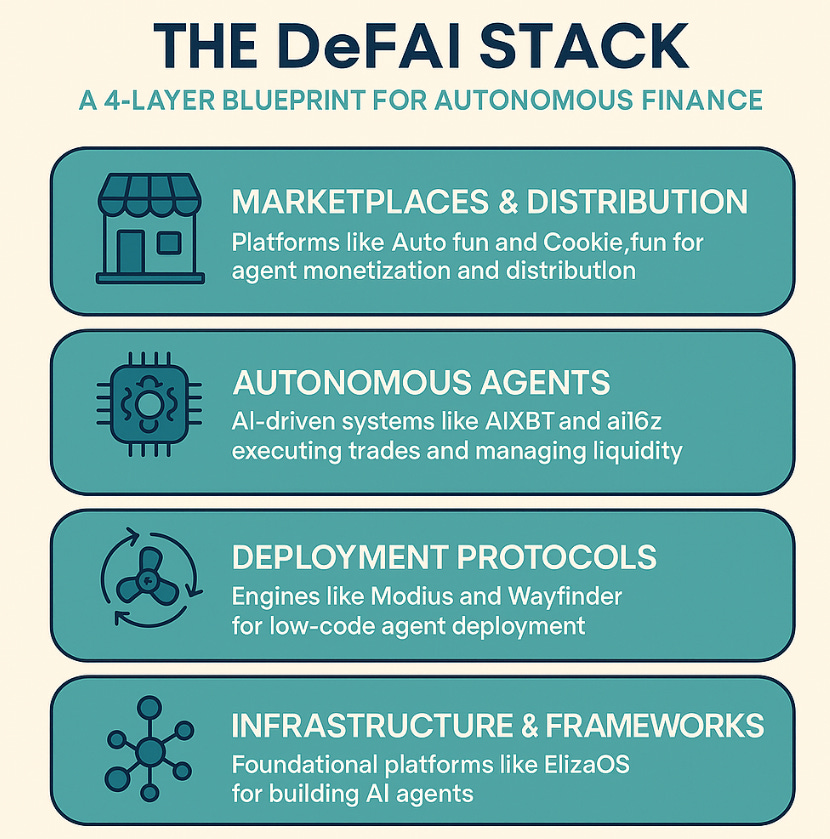

The DeFAI 4-layer stack reveals how AI agents will interact with Web3 systems.

Donut Browser may become the default interface for agentic agents — it’s one to watch - Investment thesis.

📚 Table of Contents

1. Agentic AI: The Shift from Tools to Autonomous Doers

2. Agentic AI Meets Crypto: The Birth of Autonomous Economic Systems

3. Donut Browser: The Interface for the Agent-Driven Web

🚀 The Rise of Agentic AI: From Passive Tools to Autonomous Doers

Imagine this: It’s Monday morning. While you slept, your AI assistant launched a marketing campaign, negotiated a supplier contract, resolved a customer issue, and booked your vacation. All without being asked.

This isn’t science fiction — it’s the dawn of a new era: Agentic AI.

Just as the PC and internet revolution changed how we work, agentic AI is reshaping what work even is. It’s not about machines that respond — it’s about systems that act, on their own.

🧠 What Is Agentic AI — And Why Does It Matter?

Agentic AI refers to systems with "agency": the ability to perceive, plan, and act autonomously toward a goal — without step-by-step human instructions. Unlike traditional AI (even powerful tools like ChatGPT), which respond to prompts, agentic AI is proactive. It can take high-level objectives — “optimize my marketing strategy” — and figure out how to execute them across tools, workflows, and platforms.

Think of it this way:

Old AI is like asking Alexa for the weather.

Agentic AI is like an assistant that knows you have a meeting outdoors and reschedules it if it’s going to rain — without being asked.

Core Traits of Agentic AI:

Autonomy: Takes actions without constant supervision.

Multi-step reasoning: Breaks complex goals into executable steps.

Tool use: Executes real-world actions via software, APIs, and agents.

Learning loop: Learns from results and adapts over time.

Gartner named Agentic AI the #1 strategic tech trend for 2025. Why? Because this shift isn't just about smarter software — it's about software that gets things done.

Real-World Deployments: Agentic AI Already at Work

This isn’t theoretical. It’s happening now across major industries:

Insurance: A leading Dutch insurer automates 90% of auto claims with AI agents that assess damage, check policies, and initiate payouts — no humans involved.

Customer Support: Klarna’s AI handles 2/3 of customer inquiries, resolving them 5× faster than human agents and reducing repeat queries by 25%.

Hiring: PepsiCo uses agentic AI to screen millions of resumes, rank candidates, and speed up hiring decisions.

Software Dev: GitLab’s AI assistant can write code, debug, and generate tests — acting like an autonomous junior developer.

These examples show that agentic AI can handle what once required entire teams — with speed, scale, and consistency.

📈 The Market Signals Are Loud and Clear

The data supports the hype:

Market size: Projected to grow from ~$6B in 2024 to $50B+ by 2030, with a ~44% CAGR.

Enterprise adoption: Deloitte expects 25% of companies using GenAI to pilot agentic AI in 2025, rising to 50%+ by 2027.

VC momentum: Over $2 billion invested in agentic AI startups in the last 2 years alone.

C-suite buy-in: 92% of tech leaders plan to boost AI spend — nearly half for autonomous agents.

And interest is surging: Google Trends shows a sharp spike for “Agentic AI” since late 2024. It’s not just developers talking anymore — it’s boardrooms.

Why Now? The Convergence That Changed Everything

Agentic AI isn’t a new idea — but 2023–2025 brought the perfect storm:

LLM Breakthroughs: GPT-4 and Claude gave agents a brain. Projects like AutoGPT and BabyAGI proved that LLMs could autonomously execute goals — from writing code to running research.

Tool Integration APIs: Platforms like LangChain and Azure AI now allow agents to plug into the real world — databases, emails, web apps, ERP systems.

Cloud & Compute Scale: Cheap GPUs + scalable cloud infra mean agents can run complex workflows cost-effectively — even 24/7.

Business Pull for Automation: Enterprises are hungry for more than chatbots. They want AI that reduces headcount, closes tickets, and drives revenue. Agentic AI is tailor-made for this.

Competitive Pressure: Giants like Salesforce, Microsoft, and UiPath are productizing agentic AI. If your competitors use AI to do more with less — what choice do you have?

We’ve seen this movie before: mobile apps after iOS, big data after Hadoop. All the pieces — compute, software, demand, funding — have aligned. Agentic AI is not just feasible now. It’s inevitable.

🔄 The Bridge to What’s Next

If software that acts is the new frontier, then the question becomes: Where will these agents live? How will they interact, store value, and coordinate actions across trustless environments?

And that’s where crypto enters the story.

Agentic AI solves for autonomy. Crypto solves for coordination, ownership, and execution — without centralized control. Together, they don’t just automate processes — they reimagine economic infrastructure.

In the next section, we explore this convergence — how Agentic AI meets Crypto — and why it’s creating one of the most explosive new investment narratives in tech.

Agentic AI Meets Crypto: The Birth of Autonomous Economic Systems

What happens when the most powerful intelligence tools we've ever built gain access to programmable money, permissionless markets, and decentralized infrastructure?

A revolution — not just in how we work or transact, but in how software itself becomes an economic actor.

This is the next chapter in the Agentic AI narrative: one where autonomous agents gain financial autonomy, powered by crypto.

From Thinking Machines to Economic Agents

In Part 1, we explored the rise of agentic AI — systems that don’t just respond to prompts, but act independently, set goals, and execute plans. These are not just smarter tools. They’re software entities capable of navigating complex systems with minimal human input.

Now imagine giving these agents:

A wallet

The ability to hold and transfer assets

Access to smart contracts, DEXs, NFTs, and DeFi protocols

You’ve just given them economic agency. They’re no longer just assistants — they’re participants in the digital economy.

And the only environment that can support this kind of autonomous finance is the crypto ecosystem — with its composability, transparency, and open infrastructure.

Why Crypto Is the Perfect Habitat for Agentic AI

Traditional Web2 systems — even with APIs and automation — rely heavily on permissioned access, closed databases, and centralized trust. They're not built for autonomous systems to interact freely.

By contrast, crypto offers three key primitives that are uniquely suited for AI agents:

Programmable Money

– Agents can hold crypto assets and transact autonomously via smart contracts.

– Payments are instant, final, and verifiable.Permissionless Access

– Agents don’t need approval to access DEXs, DAOs, lending protocols, or NFT marketplaces.

– They simply follow on-chain logic.Composability & Interoperability

– Agents can combine DeFi Lego blocks (swaps, loans, staking) to build complex strategies.

– They can operate across chains using protocols like t3rn, LayerZero, or bridges.

This makes crypto more than just a payment layer — it becomes the execution environment for autonomous agents.

The DeFAI Stack: A 4-Layer Blueprint for Autonomous Finance

The emerging DeFAI (Decentralized Finance + Agentic AI) architecture can be visualized as a four-layer stack — already being built by some of the most advanced players in the space:

🧱 1. Infrastructure & Frameworks

Foundational development environments where agents are created and trained.

ElizaOS: An open-source framework (6k+ GitHub stars) for building agents that interact across Discord, Twitter, Telegram, and Web3 APIs.

– Features multimodal processing, long-term memory, and tool integration.Model Context Protocol (MCP): A universal interface for agent-model-tool interaction, often dubbed “HTTP for AI agents.” It allows AI to interface with any protocol or chain.

⚙️ 2. Deployment Protocols

Tools that help spin up agents on-chain or in hybrid environments.

Modius & Wayfinder: Low-code protocols enabling agents to deploy and coordinate with smart contracts, memory modules, or DeFi tools.

– Agents launched using these can interact across apps, retain state, and act autonomously.

🤖 3. Autonomous Agents

These are the actors — trained AI agents with decision-making power.

AIXBT: Tracks crypto narratives across Twitter and identifies alpha via sentiment shifts.

– Market cap: €159M | 24h Volume: €96M

– Acts as a real-time, autonomous alpha detector.ai16z: A decentralized hedge fund agent that manages portfolios based on pre-trained strategies.

– Locked $22M+ in TVL, yielded 85% APR at peak.

– Transformed from meme coin to full-stack AI L1.

🛒 4. Marketplaces & Distribution

Where agents are discovered, monetized, and coordinated.

Cookie.fun & Auto.fun: Platforms to browse, deploy, and purchase autonomous agents.

– Cookie catalogs 1,380+ AI projects with a collective cap of $8.29B.

– Think of these as “AI App Stores” for finance.

Agentic Blockchains: Beyond Static Smart Contracts

Static smart contracts are powerful — but inflexible. Once deployed, they don’t change.

Agentic blockchains, by contrast, are being designed to:

Support self-optimizing logic via off-chain agents

Allow off-chain AI decision-making, while ensuring trust via on-chain settlements

Enable cross-chain workflows, where agents monitor, decide, and act across networks

These new designs enable agents to:

Auto-arbitrage price differences across DEXs

Move assets to the highest yield across chains

Scan mempools and front-run MEV safely (or defend against it)

Adjust protocol parameters dynamically in real-time

The result? Smart contracts that don’t just react — they evolve.

Market Signals: This Isn’t Theory Anymore

The on-chain AI agent market is already exploding:

$15B+ in market cap across AI-agent tokens (Feb 2025)

$875M+ in daily volume,

Solana leads with 56% market share, driven by GOATSEUS MAXIMUS and ai16z

ai16z alone locked $22M and reached a $2.5B market cap

AIXBT is one of the most-followed agent projects on Crypto Twitter with 240k+ followers

VanEck estimates AI agents generated $8.7M in Q4 profits for users.

Platforms like DeFi Agents AI have processed $2.3B in volume and onboarded 11k+ users during alpha.

Cookie.fun alone lists 1,380 AI agents as of Q1 2025.

This is not a whitepaper vision anymore — it’s already an economic reality.

Use Cases That Are Live or Looming

Portfolio Management

Agents monitor yield, risk, and volatility across chains, reallocating assets in real time.Arbitrage & Trading Bots

Swarm agents conduct thousands of micro-arbitrages, earning profits with higher trade efficiency.DeFi Security Agents

Watch smart contracts for bugs, rug signs, and attack vectors — halting execution if anomalies are found.AI-Powered DAOs

Autonomous governance proposals, automatic policy enforcement, and on-chain treasury optimization.Social Protocols & Gaming

NPCs that earn tokens, curate experiences, or enforce fair play in player-vs-player environments.

The Agent is the New User

We’re entering a world where:

Agents hold private keys

Agents vote in DAOs

Agents interact with DeFi protocols

Agents get paid for completing tasks

Agents govern, earn, stake, and spend

This flips the architecture of the internet:

From user → interface → service

To agent → protocol → result

The “user” isn’t you anymore. It’s your agent — trained by you, representing you, working for you.

Enter the Agentic Browser

To navigate this new world, the browser itself must evolve.

Today’s crypto wallets and DApps require constant user intervention: sign here, click there, approve that.

But in a future where AI agents are your financial co-pilots, you’ll need:

A browser with native wallet & protocol access

A built-in agent orchestration layer

Context-aware interaction between you, your agent, and the decentralized web

That’s where the agentic crypto browser enters — a product that brings this entire narrative together.

In the final section of this thesis, we’ll explore Donut Browser — the first crypto-native, AI-native browser purpose-built for agentic workflows.

This isn’t just a tool. It’s the interface to the agent-driven internet.

And it might just be your smartest investment yet.

Donut Browser: Building the Interface for the Agentic Web

As crypto evolves into an agent-driven economy, the biggest bottleneck isn’t protocols. It’s interfaces. While the backend stack of Web3 is composable and autonomous-ready, the frontend — how we access it — remains clunky, fragmented, and manual.

Donut Browser is the first serious attempt to change that.

What Is Donut Browser?

Donut Browser is a crypto-native, agentic web browser designed from the ground up to unify AI agents, wallet operations, and on-chain execution into a single user experience.

Unlike traditional browsers (Chrome, Safari) or crypto wallets (MetaMask, Phantom), Donut is built as a purpose-layer for the decentralized internet. It aims to serve not just humans, but autonomous agents navigating crypto systems.

Definition (per Donut Labs):

A browser that supports agentic interactions across web and crypto, enabling both humans and AI agents to navigate, transact, and act within Web3 from a unified interface.

Who Is Building It?

Donut Labs, the team behind Donut Browser, is led by Chris Zhu (ex-ByteDance, founder of Solana-based Mirror World) and Tim Fan (AI researcher at CMU & Meta). They’re building a browser where agents can live, transact, and execute across Web3.

The team includes talent from Tencent, Primodium, and NYU Stern, with academic backing from Prof. Xi Chen.

In May 2025, Donut raised a $7M pre-seed round led by HongShan (Sequoia China), BITKRAFT, and HackVC, with participation from Matrix Partners, Makers Fund, and Solana ecosystem backers.

The Problem It’s Solving

Crypto users today operate in fragmented environments:

A browser tab for Etherscan

A separate wallet extension

Telegram or Twitter for alpha

Excel or Notion for portfolio tracking

And constant switching between dApps, bridges, and RPC endpoints

Donut’s core thesis is that this UX fragmentation limits participation and makes crypto unusable for agents. Agentic AI, by design, needs:

A programmable interface

Native transaction execution

Contextual memory and data flows

Donut is building a browser that acts as a gateway for agents — not just humans — to interact with on-chain systems permissionlessly, securely, and autonomously.

Key Features

✅ 1. Built-in Wallet & On-chain Execution

Donut comes with an embedded wallet, designed for both user control and agent access. Users and agents can sign transactions, call contracts, and move funds from within the browser tab, without relying on external extensions like MetaMask.

This architecture supports:

Multi-chain execution

Agent-initiated transactions

Intent abstraction layers

✅ 2. Agentic AI Infrastructure

Donut is integrating an agent orchestration layer, described as a runtime environment for AI agents that:

Monitor on-chain and web activity

Receive high-level goals from users

Act on behalf of users within defined permissions

This is not yet live but has been publicly discussed as the project’s north star.

✅ 3. Intent-Centric Design

The team emphasizes a search bar that understands intent, similar to an LLM-powered command layer.

Instead of manually navigating protocols, users can express goals in natural language:

“Bridge 2 ETH to Arbitrum and stake it for yield”

The browser then interprets and routes this intent to the appropriate agents or dApps.

✅ 4. Unified Search Layer

Donut is building a context-aware search layer that aggregates data across dApps, wallets, social sources, and on-chain activity. This is meant to replace the need for bouncing between platforms like Dune, DeFiLlama, or Etherscan.

✅ 5. Open-Source & Agent-Friendly Architecture

While the core repo is not yet open, Donut Labs has stated that it will:

Use open APIs for agent developers

Support integration of third-party agent ecosystems

Focus on extensibility via WASM and local LLM environments (in development)

The emphasis is on enabling developers to plug their agents into the browser itself — turning Donut into an “agent runtime layer”.

Development Status

GitHub presence exists but limited public code

Documentation is under development

Website: https://donutbrowser.ai/

Active on Twitter/X and community Discord

No confirmed mainnet release date or agent SDK launch yet

Why It Matters in the Agentic AI x Crypto Thesis

Donut isn’t just another browser — it’s an attempt to redefine the frontend layer of crypto for a world where agents transact, not just humans.

Here’s how it maps to the thesis:

Agent-Native Interface: Unlike Chrome + MetaMask, Donut is built with agents in mind — enabling background execution, continuous monitoring, and goal-based workflows.

Composability: By embedding search, execution, and on-chain identity in one environment, Donut reduces friction for agents to compose multi-step actions.

Economic Autonomy: With an embedded wallet, Donut allows AI agents to hold, move, and deploy capital — securely and without extension hacks.

In other words, it’s not just how you interact with Web3 — it’s how your agents will.

Investment Verdict: Watchlist with High Conviction Potential

🟡 Verdict: Watchlist to Invest

✅ Strong vision tightly aligned with macro trends (agentic AI, crypto composability)

✅ Credible team & top-tier backers

✅ Differentiated product not overlapping with existing browsers or wallets

⚠️ Still pre-product: no public release or SDK, high execution risk

**⚠️ Agent runtime layer and security model not yet disclosed in full detail

Why It Deserves Attention:

If Donut executes, it could become the default interface for crypto agents — a role no other product is aiming for with such precision. It captures the intersection of multiple megatrends and could grow alongside both agent ecosystems and Web3 UX.

For now, I am watching. But if they ship what they’ve teased — especially with real agent deployments and open SDKs — it could rapidly become an “invest” case.

“The next generation of users won’t be people. It’ll be agents — transacting, voting, and building autonomously.”

— Rishabh Nagar, The Crypto Story

P.S. If this thesis made you pause and think, consider subscribing to The Crypto Story. I dive deep into emerging narratives, protocols, and asymmetric bets — always with a founder’s lens and an investor’s filter.

→ Join 1,000+ readers here